Language model research has rapidly advanced, focusing on improving how models understand and process language, particularly in specialized fields like finance. Large Language Models (LLMs) have moved beyond basic classification tasks to become powerful tools capable of retrieving and generating complex knowledge. These models work by accessing large data sets and using advanced algorithms to provide insights and predictions. In finance, where the volume of data is immense and requires precise interpretation, LLMs are crucial for analyzing market trends, predicting outcomes, and providing decision-making support.

One major problem researchers face in the LLM field is balancing cost-effectiveness with performance. LLMs are computationally expensive, and as they process larger data sets, the risk of producing inaccurate or misleading information increases, especially in fields like finance, where incorrect predictions can lead to significant losses. Traditional approaches rely heavily on a single dense transformer model, which, while powerful, often needs help with hallucinations, where the model generates incorrect or irrelevant information. Large financial applications requiring fast, accurate, and cost-efficient models amplify this problem.

Researchers have explored several methods to address these challenges, including ensemble models, which involve multiple LLMs working together to improve output accuracy. Ensemble models have successfully reduced errors and improved generalization, especially when dealing with new information not included in the training data. However, the downside of these systems is their cost and slow processing speed, as running multiple models in parallel or sequence requires significant computational power. The financial sector, which deals with massive amounts of data, often finds these solutions impractical due to the high operational costs and time constraints.

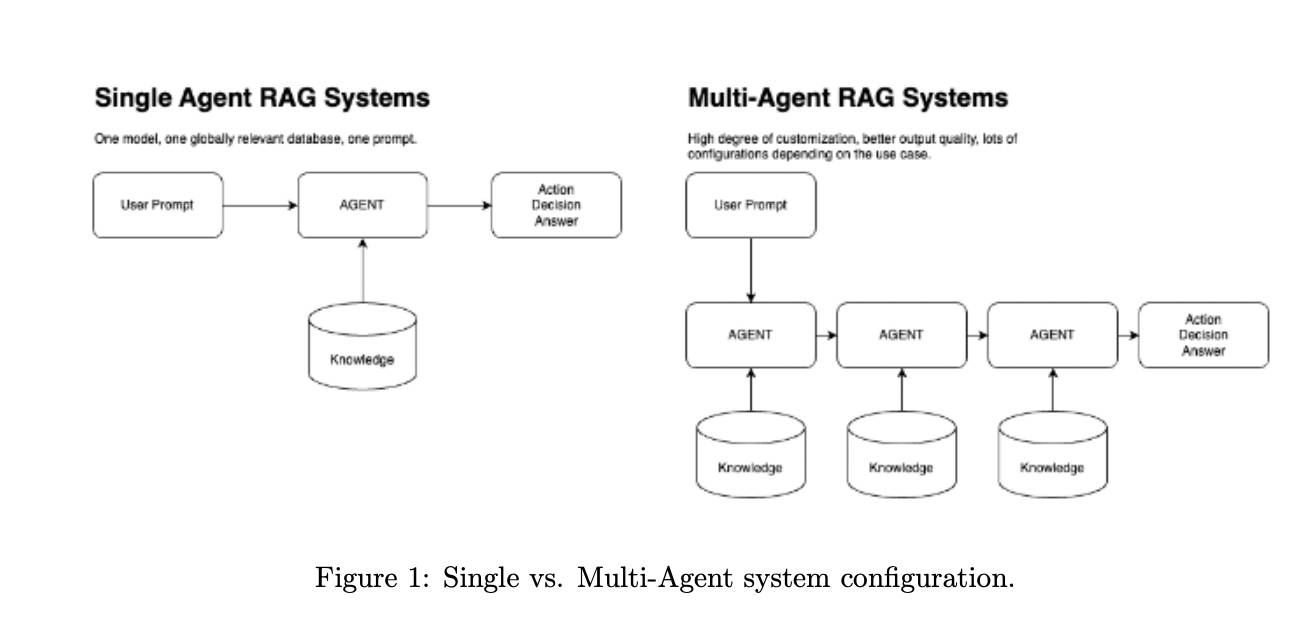

Researchers from the Vanguard IMFS (Investment Management FinTech Strategies) team introduced a new framework called Mixture of Agents (MoA) to overcome the limitations of traditional ensemble methods. MoA is an advanced multi-agent system designed specifically for Retrieval-Augmented Generation (RAG) tasks. Unlike previous models, MoA utilizes a collection of small, specialized models that work together in a highly coordinated manner to answer complex questions with greater accuracy and lower costs. This collaborative network of agents mirrors the structure of a research team, with each agent having expertise and knowledge base, enabling the system to perform better across various financial domains.

The MoA system comprises multiple specialized agents, each acting as a “junior researcher” with a specific focus, such as sentiment analysis, financial metrics, or mathematical computations. For example, the system includes agents like the “10-K/Q Math Agent,” a fine-tuned GPT-4 model designed for handling accounting and financial figures, and the “10-K/Q Sentiment Agent,” a Llama-2 model trained to analyze sentiment in equity markets. Each agent has access to different data sources, including databases, APIs, and external documents, allowing them to process highly specific information quickly and efficiently. This specialization enables the MoA framework to outperform traditional single-model systems in speed and accuracy while keeping operational costs low.

In terms of performance, the MoA system has shown significant improvements in response quality and efficiency compared to traditional single-model systems. During tests, the MoA system could analyze tens of thousands of financial documents in under 60 seconds using two layers of agents. Compared to a single-model system, these agents operate with a latency penalty of only 4.07x in serial inference or 2.24x when running in parallel. A basic MoA system with two Mistral-7B agents was tested in one experiment alongside single-model systems such as GPT-4 and Claude 3 Opus. The MoA system consistently provided more accurate and comprehensive answers. For example, when asked about revenue growth in Apple’s Q1 2023 earnings report, the MoA agents captured 5 out of 7 key points, compared to 4 from Claude and only two from GPT-4. This demonstrates the system’s ability to surface critical information with higher precision and speed.

The cost-effectiveness of MoA makes it highly suitable for large-scale financial applications. Vanguard’s IMFS team reported that their MoA system operates at a total monthly cost of under $8,000 while processing queries from a team of researchers. This is comparable to single-model systems, which cost between $5,000 and $8,000 per month but provide significantly lower performance. The MoA framework’s modular design allows companies to scale their operations based on budget and need, with the flexibility to add or remove agents as necessary. As the system scales, it becomes increasingly efficient, saving time and computational resources.

In conclusion, the Mixture of Agents framework offers a powerful solution for improving the performance of large language models in finance. The researchers successfully addressed critical issues like scalability, cost, and response accuracy by leveraging a collaborative agent-based system. The MoA framework enhances the speed and quality of information retrieval and offers significant cost savings compared to traditional methods. With its ability to process vast amounts of data in a fraction of the time while maintaining high accuracy, MoA is set to become a standard for enterprise-grade applications in finance and beyond. This system represents a significant advancement in LLM technology, providing a scalable, cost-effective, and highly efficient method for handling complex financial data.

Check out the Paper. All credit for this research goes to the researchers of this project. Also, don’t forget to follow us on Twitter and join our Telegram Channel and LinkedIn Group. If you like our work, you will love our newsletter..

Don’t Forget to join our 50k+ ML SubReddit

The post Collaborative Small Language Models for Finance: Meet The Mixture of Agents MoA Framework from Vanguard IMFS appeared first on MarkTechPost.